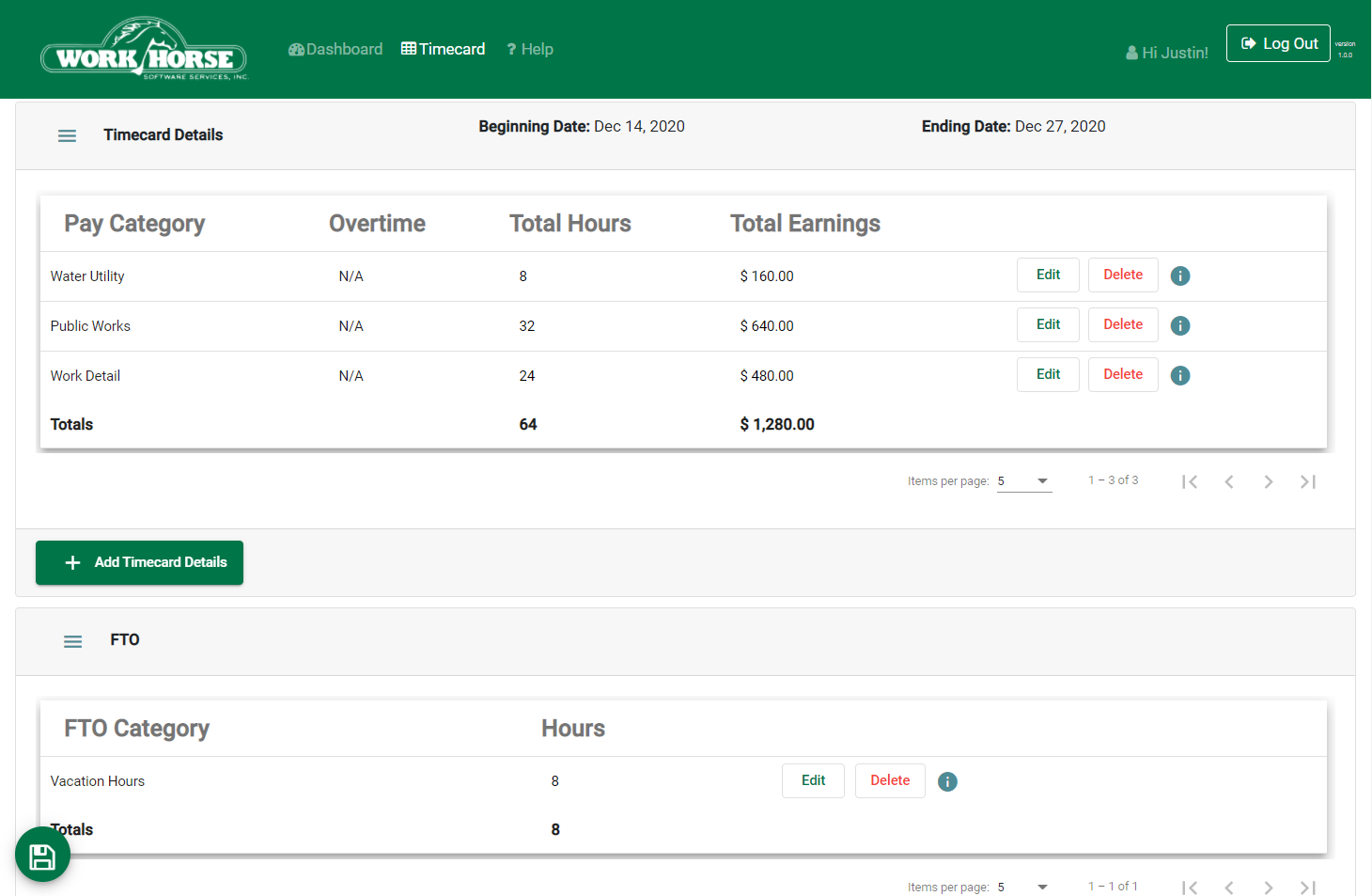

TriNet provides its customers with a tool to assist them in conducting individualized risk assessments prior to making final FLSA status determinations for their employees. Different exemptions and criteria may apply at the industry, local, or state levels. There may be other requirements that must be met for nonexempt employees depending on the work location and industry, such as providing compliant meal and rest breaks.įact Sheet 17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) outlines the federal criteria for each of the white-collar exemptions under which an employee may be designated under the FLSA. Productivity theft has been a big problem. The extensive available features, rich customization and simple payroll integration make our timesheet software the perfect choice for small businesses while the scaling architecture. With more than 9,000+ highly satisfied customers and managing 10 lakh employee records daily, it delivers high-quality software service on a 24 x 7 basis. It automates key areas of HR, Payroll Management, leave, and attendance tracking.

Certain employees may be designated as exempt from minimum wage and overtime pay under administrative, professional, executive, computer or outside sales exemptions, among other potential exemptions, if they satisfy both a job duties test and a salary basis test. Ontime employee management system supports your efforts of managing the work hours of your executives smartly. On-Time Web is a web timesheet software solution that puts the power of employee time tracking, employee leave tracking and project tracking at your fingertips. greytHR is the preferred Payroll software for Indian businesses. The Fair Labor Standards Act (FLSA) and various industry, local and state laws and regulations establish criteria for minimum wage and overtime pay. As a result, penalties for failing to pay your payroll taxes and filing your payroll tax returns on time are much more severe than other types of penalties. Full Guide - Web Based Time Management System. Employer User Guide Approve your Timesheet. Any questions regarding timesheets please contact our Hays payroll team. Get Ontime Payroll reviews, ratings, business hours, phone numbers, and directions. The user friendly system is key to delivering a first class service to our temporary workers and client employers. Ontime Payroll can be contacted at (781) 209-1188. Taxes filed on time, every time 100 guaranteed Access to secure client portal via web and mobile devices Self-service employee portal with access.

Click here for traditional paper processing.The main difference is that nonexempt employees are subject to minimum wage and overtime pay, among other requirements, while exempt employees are not. Ontime Payroll is located at 2 Winter St Ste 101, Waltham, MA 02451. There are benefits to you when choosing paper, as well. We also offer a library of standard reports but take pride in our ability to work with you to design meaningful reports to analyze employee information and steer business decisions.Ĭonsider the benefits to you when you choose paperless processing: employee self-service, no lost checks, vouchers or reports, easy electronic access to employee information, no physical storage requirements, time saved traveling to pick up physical checks, etc. We take the hassle and worry away from the payroll process by ensuring your salaried employees walk away with accurate and on-time wage slips, without fail. While we were all similarly affected, we are fortunate to be able to offer our customers a touchless, paperless experience that had already been established as our standard. Over the last year, we were all forced to consider new ways of doing business in a touchless environment.

Direct access for employees eliminates extra. Operating as a predominately paperless service bureau, gave us stand-out status. Instant access & reporting Our secure client portal allows you to input payroll and pull detailed reports. We started out in this industry as leaders in paperless payroll processing and continue operations with over 90% of our clients using our paperless processing and delivery options. Payroll is so much more than just a paycheck Whether you have one or 1,000 employees, you are in one or 50 states, or you are a new or well established company, Time & Pay can provide you with cost-effective systems and services that help you better manage your payroll, employees and business.

0 kommentar(er)

0 kommentar(er)